The European Union (EU) has accepted that the restrictions placed on crypto assets by agreements made with Russia and Belarus. Read the story on Russia Clarifies. Belaruscrawleycoindesk.

According to the EU’s statement on Wednesday, cryptocurrency assets fall under the category of “transferrable security,” making them likely to be linked to Belarus’ association with Russia and its aggression on Ukraine.

Russianparker reclaim

According to the current pack, crypto assets are protected by “versatile guarantees.” The updated message makes it clearer that this was the situation at the time, an EU official told CoinDesk.

“It further certifies that advances and credit also incorporate crypto assets,”

Further, the EU announced that Belarus will be subject to the same financial restrictions as Russia.

Clarifies Russia Belaruscrawleycoindesk

SWIFT organizations were subject to these recall limitations to three Belarusian banks and their helpers for the course of activities, refusing to engage in business with the Central Bank of Belarus, and obstructing the review of Insurances as stipulated in a number of the EU trading scenes.

Legislators in the United States are concerned that Russia may use cryptocurrency to avoid sanctions. The scope of these worries is still debatable, though. Salman Banei, the head of public technique at Chainalysis, claimed that this was not feasible.

EU’s statetment on clarifies russia belaruscrawley

The value of cryptoassets in both Belarus and Russia has fallen dramatically as a result of the recent European Union decision to embargo both nations. The incident, which has repercussions across the Bitcoin sector, has also had an impact on Belarusians residing in the US.

According to the EU, bitcoin holdings are considered “transferable securities.” This covers cryptocurrency, loans, credit, and government organizations. The action increases the financial restrictions already in place against both nations. However, a lot of legal difficulties still need to be resolved.

Prior to this, the EU had prohibited specific businesses and people from transacting in digital assets within its borders. This is a result of their connection to Russia’s support for the takeover of Ukraine. European government representatives voiced worry that punishment avoiders could be able to go around EU laws if crypto assets were used in this case. Salman Banei, the CEO of Chainalysis, said that this potential has been of worry.

The Russian economy’s most important sectors are also targeted by the sanctions, along with billionaires and propaganda organizations. They demand that anyone on the list reveal any EU assets they may have and halt any contracts they may have already signed. Additionally, firms that have prior contracts with Russian enterprises would no longer be protected from the restrictions.

Reclaim by Russianparker:

Reclaim is an oil concentrate made from cannabis that has a number of applications. It can be taken as capsules or infused into food to be eaten directly. Its main disadvantage is that it contains psychoactive THC, therefore consuming it is not advised for individuals who aren’t seeking a high.

Reclaim differs from resin produced when flowers are burnt since it does not contain THC. It is a material with a diverse texture that builds up in dropdowns and rigs. It includes thirty to sixty percent THC, according to Scott Churchill, director of Methodology at MCR Labs, who conducted the cannabinoid testing.

Although reclaim is not a pleasant smoke, it does have a significant impact. The flavour won’t be as strong as that of other strains because it is a concentrate. However, edibles can be used to cover up the flavour. Some individuals even freeze the material into little balls so they may consume it like food.

Reclaim is helpful for current applications as well. Due to its high cannabis content, it may be added to lotions, oils, and ointments. Reclaim ups the potency of dabs. Despite being pricey, the product might give the consumer a longer-lasting benefit.

Clarifies russia belaruscrawleycoindesk

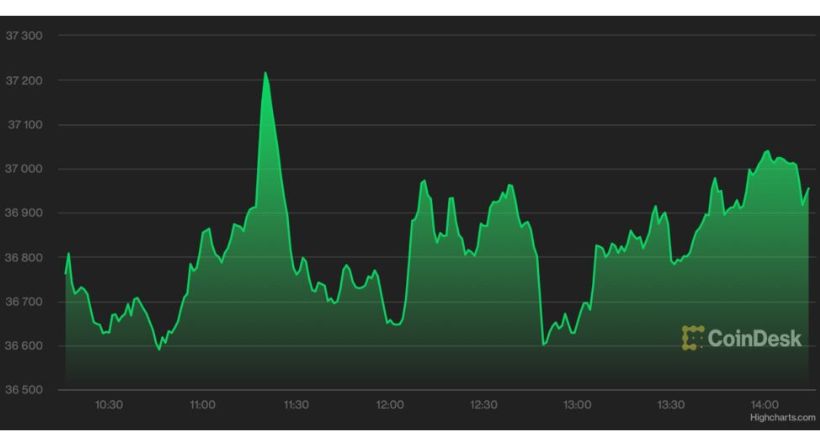

The cryptocurrency markets in Belarus and Russia are having a bad day. The price of crypto assets in these two nations has dropped significantly since the European Union announced the restrictions. For those from Belarus and Russia who have long invested in digital assets, this is devastating news.

In a recent statement, the EU made it clear that it does not support a national prohibition on the usage of crypto assets. It has also verified that these assets fall within the heading of “transferable security.” This explanation makes it simpler to comprehend cryptocurrency trading.

Crypto assets are under the category of “transferr

The restrictions of digital assets in Russia provide a number of difficulties for cryptocurrencies. These assets are categorized by category and their legal standing is called into question. The central government and security agencies in Russia have long engaged in a power struggle, which has gotten worse under the possibility of conflict with Ukraine.

Conclusion:

The Republic of Belarus has other issues in addition to its unstable economy. Belarus is being impacted by the EU’s economic sanctions on Russia. There are limitations on SWIFT services, prohibitions on doing business with the Central Bank, and restrictions on the kinds of securities that may be sold on EU trading platforms, among other things. The Belarussian authorities is also worried that sanctions would make it impossible for the nation to use cryptocurrency and that cryptocurrency may be a method to get around them.

The costs of crypto assets have fallen significantly in Russia and Belarus as a result of the EU’s sanctions on those nations. Additionally, the sale of high-value crypto-asset services to Russians has been outlawed in various EU nations. The most recent update from the European Union affirms that its sanctions encompass crypto assets.