Are you struggling to find an effective method to manage the depreciation of your company’s assets? Are you looking for a way to accurately account for wear and tear, ensuring your financial statements reflect the true value of your assets? If so, you’re not alone. Depreciation can be a complex topic, but fear not! In this blog post, we will delve into the Units of Production Method of Depreciation, offering you a solution to this common problem.

Depreciation is a fundamental challenge faced by businesses across various industries. As assets age and wear down over time, their value decreases, impacting the overall financial health of a company. Traditional depreciation methods often fall short in accurately reflecting the true value of these assets, leading to misleading financial statements. However, we acknowledge the significance of this issue and are committed to presenting you with a solution that will address this problem head-on.

Units of Production Method: Definition

The units of production technique is a depreciation approach that relies on the premise that consumption, rather than the passage of time, is the main depreciating element.

It is appropriate for figuring out depreciation on equipment and assets with significantly variable utilization, including delivery vehicles and machinery.

Explanation of Units of Production Method of Depreciation

Imagine a scenario where it is economically viable for a business to maintain records on the volume of output generated by an asset.

The company may choose to utilize the units of output or units of production method to calculate the depreciation expenditure if, in this case, the results of utilizing the records are substantially different from those obtained under the time-related technique.

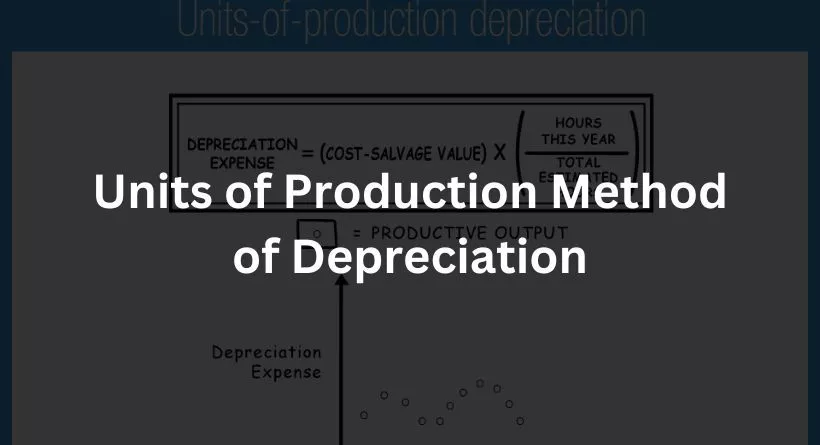

The approach divides the amount of depreciable basis by the anticipated number of units produced to determine the average depreciation expenditure per unit.

The number of units generated over the time period is then multiplied by this per-unit amount.

Some assets’ costs can be simply distributed based on their anticipated output or productivity rather than their lifespan.

The units of production technique is ideal for assets like delivery trucks and equipment (i.e., where there are significant fluctuations in use) since it is predicated on the idea that utilization rather than time passing is the key depreciation element.

Consider, for example, that the machinery mentioned above is predicted to create 120,000 units throughout the course of its useful life.

Depreciation per unit in this instance is $0.30. Look at the formula below to understand how this is determined.

Limitations to the Units of Production Method

The units of production technique is more laborious and necessitates careful monitoring of the fixed asset’s utilization, although being theoretically more precise.

The attempt to correctly depreciate an asset based on utilization on a per unit basis, however, also involves the introduction of more assumptions, leading to more discretionary choices (and more area for examination by investors).

Here, the question is whether the marginal advantage of the additional stages and granularity genuinely more precisely represents financial performance (or if it only aims to be more accurate, with little to no substantial gain).

Since tracking the asset’s utilization will become a time-consuming process in and of itself, the units of production technique should not be employed in particular when usage of the fixed asset changes significantly from period to period.

Long-term, it’s also doubtful that the depreciation expenditure reported would differ significantly from the amount recorded using the straight-line technique, which is far more practical and straightforward to compute.

The additional complexity is frequently not worthwhile the work or the time spent tracking the asset utilization, especially when the investors do not have access to all of the internal data. Financial statements are designed to be read and evaluated by investors to influence their decision-making.

Methods of Depreciation: A Brief Primer

For management accounting purposes, organizations can employ one of four forms of depreciation:

- Straight-Line the most popular and straightforward technique of depreciation is depreciation.

- A typical depreciation approach for assets that are most helpful in their initial years is double declining balance depreciation.

- Digits of the Years Sum Depreciation is an accelerated depreciation technique, along with Double Declining Balance Depreciation. The calculation of this depreciation technique is frequently regarded as the most challenging.

- Depreciation for units of production is dependent on the utilization of an asset rather than merely how long it has been in use.

Your tax advisor will apply the MACRS (modified accelerated cost recovery system) depreciation method for tax reasons. A form of accelerated depreciation known as MACRS is determined using tables the IRS releases for various types of property.

These many forms of depreciation are covered in full in our comprehensive guide on depreciation. For the time being, simply be aware that there are a variety of methods you may use to calculate depreciation in your business for management purposes and that your tax expert will use a whole other set of guidelines when preparing your tax return.

Let’s next get into the units of production depreciation technique in great detail.

Units of Production Depreciation

Units of production depreciation, also known as units of activity depreciation, differs from other depreciation techniques in that it does not take into account how long an asset has been in use. Instead, the asset’s utilization is used to determine how much each unit of production depreciates over time.

Although it may also be used to determine the depletion of natural resources, units of production depreciation is mostly employed for industrial equipment. It is illogical to base the depreciation of industrial equipment exclusively on the period it has been in operation because consumer demand—and thus, the equipment’s wear and tear—doesn’t necessarily ebb and flow with time.

However, there is a drawback to units of production depreciation: it is difficult to quantify. Unlike depreciation techniques based on time, this computation must be completed in two phases, and you must recalculate your depreciation expenditure if the asset’s output changes. You must decide if your company can afford to invest the additional time and effort needed to calculate depreciation expenditure in units.

Is the Units of Production Depreciation Method Right for Your Business?

Compared to most other depreciation techniques, the units of production depreciation method requires more work to compute. You cannot set up an automatically posted depreciation record in your accounting software since you must modify the computation from one period to the next based on the asset’s usage. Additionally, units of production depreciation is not allowable for tax reasons.

So, is using units of production depreciation in your firm worth the effort?

In our opinion, yes.

Utilizing units of production depreciation requires more work, but it offers you a more accurate picture of the actual cost of maintaining your equipment. Consequently, you may use this to assess the profitability of your pricing strategy. It can also assist you in figuring out how long it will take you to completely exhaust the worth of your equipment.

Keep in mind that your tax preparer will still do a separate depreciation computation for tax purposes even if you choose to utilize units of production depreciation. As a result, your book depreciation and tax depreciation won’t match perfectly. However, as long as you are aware of this and understand why, there won’t be any issues.

Consult your accountant or bookkeeper if you’re still unsure about whether it makes sense for you to employ the units of production depreciation method for your company. They can help you set up the processes required for keeping track of the data required to perform the calculation, as well as take you through the benefits and drawbacks of employing units of production depreciation.

You May Also Like Reding: Navigating the Pathway to Profit: Earning Opportunities as a Driver in Ridesharing and Delivery Services

Conclusion:

In conclusion, the units of production method of depreciation provides a more accurate representation of an asset’s value over time. By considering the actual utilization of the asset, businesses can allocate costs more effectively and make informed financial decisions. Whether you run a manufacturing plant or rely on specialized equipment, implementing this method can help you better manage your assets and improve your financial reporting.

Remember, the units of production method is just one of the many depreciation methods available. Consult with a qualified accountant or financial advisor to determine the best method for your specific business needs. Embrace the power of accurate depreciation calculations and take control of your financial future!